Cryptocurrency Exchange Auto-Trading System

Description

Key Concepts and Functions of the Auto-Trading System:

Automated Trading: The auto-trading system is designed to automate trading operations on cryptocurrency exchanges. It uses predefined rules and algorithms to make decisions regarding the buying and selling of cryptocurrencies.

Technical Analysis: The system is built upon technical analysis of the market. It can analyze price charts, trading volumes, indicators, and other parameters to identify optimal entry and exit points for trades.

Market Signal Response: The system can respond to various market signals such as price changes, trading volumes, moving averages, etc. This enables the system to quickly adapt to changes and adjust to current market conditions.

Trading Strategies: Users can configure different trading strategies within the system. These could include strategies based on moving averages, stochastic oscillators, arbitrage opportunities, and more.

Risk Management: Many auto-trading systems offer risk management features, such as setting stop-loss and take-profit levels. This helps minimize losses in case of unfavorable market movements.

Project Goal

The objective of the project to develop an auto-trading system for cryptocurrency exchanges is to create an intelligent system that automates the trading process on these exchanges. The project aims to provide traders with the ability to efficiently participate in market operations using algorithmic strategies and data analysis.

Advantages of the Auto-Trading System:

Efficiency: The system operates 24/7 and can swiftly respond to market changes, a feat that can be challenging for manual traders.

Emotion-Free: The system relies on algorithms and doesn’t experience emotional reactions. This prevents decisions based on fear or greed.

Automatic Execution: All trades are executed automatically based on predefined rules. This eliminates errors associated with human factors.

Phases

1.Planning and Analysis: Defining the system’s features and capabilities, selecting cryptocurrency exchanges for integration, determining algorithmic strategies.

2.Technical Architecture: Developing the system’s architecture, selecting frameworks and libraries, defining modules.

3.Integration with Cryptocurrency Exchanges: Developing modules to integrate with various cryptocurrency exchanges through their APIs.

4.Implementation of Trading Strategies: Creating algorithmic strategies for automated trading based on data analysis.

5.Risk Module Development: Implementing a module that considers risks and constraints when making trading decisions.

6.Database Integration: Creating a module to store and analyze historical trading data.

7.Monitoring and Optimization: Implementing mechanisms to monitor and optimize strategies based on obtained results.

Technologies and Tools

Technical Details:

Technology Stack: Using Python and PHP for development. Python is used for implementing trading strategies, exchange integration, and data analysis. PHP is used for creating web interfaces and database integration.

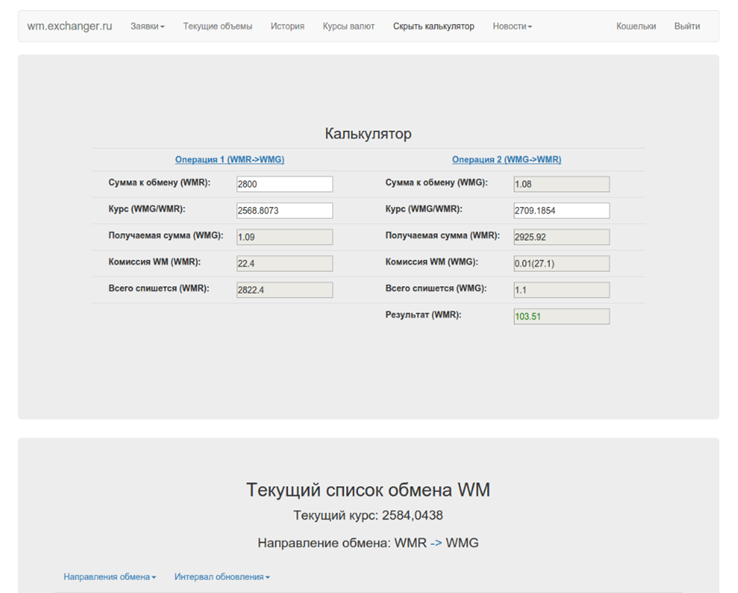

API Integration: Utilizing cryptocurrency exchange APIs to retrieve real-time trading data, orders, and trade executions.

Algorithmic Strategies: Developing strategies such as market-making, arbitrage, and trend-following.

Risk Module: Implementing a risk assessment and capital management mechanism to ensure safe trading.

Database Integration: Creating a database to store and analyze historical trading data and strategy results.

Technical Specification:

Cryptocurrency Exchange APIs: Integration with various cryptocurrency exchanges, fetching real-time market data, orders, and transactions.

Python for Trading Strategies: Using Python for the development and implementation of algorithmic trading strategies due to its flexibility and rich library ecosystem for data analysis.

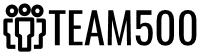

PHP for Web Interface: Utilizing PHP to create a web interface that allows managing strategies, viewing results, and configuring the system.

Capital and Risk Management: Developing algorithms for effective capital management and risk assessment to ensure safe trading.

Monitoring and Logging: Implementing a monitoring system that tracks strategy performance and issues alerts in case of problems.

Creating a Custom Headless Browser: Building a custom headless browser to automate actions on exchange websites.

Proxy Usage: Employing proxy servers to ensure anonymity and reduce the likelihood of exchange blocking.

Functionality:

Exchange Integration: Capability to integrate with various cryptocurrency exchanges through APIs. Algorithmic Strategies: Development and application of various algorithmic trading strategies for automated trading.

Risk Assessment: Module for risk evaluation and determining trading volume based on the current situation.

Monitoring and Analysis: Ability to monitor trading results and analyze strategy effectiveness.

Web Interface: Creation of a web interface for strategy configuration, monitoring, and system management.

The Results

-

Efficient Automation: Developing a system capable of automated trading on cryptocurrency exchanges using algorithmic strategies. Enhanced Efficiency: Enabling continuous trading 24/7 without the need for constant presence. Market Response: Automatic response to price changes and market conditions. Additional Opportunities: Optimization and Adaptation: Ability to optimize strategies based on historical data and adapt to changing market conditions. Analysis and Reporting: Capability to analyze trading results, generate reports, and assess strategy effectiveness. Expansion and Scalability: Ability to add new strategies, tools, and cryptocurrency exchanges to expand system capabilities.

Security and Authorization: Implementation of security and authorization mechanisms to protect data and manage access.

- The cryptocurrency exchange auto-trading system is a project aimed at creating a powerful instrumental platform for automated trading on cryptocurrency exchanges. The project seeks to provide traders with effective tools for cryptocurrency market trading, utilizing various algorithmic strategies and data analysis to make informed decisions. The technical solutions include using Python and PHP, integrating with cryptocurrency exchange APIs, developing risk management and monitoring algorithms, and creating a custom headless browser system.